Gold's Role in Global Economies: Past, Present, and Future

Gold's Role in Global Economies: Past, Present, and Future

From ancient currency to modern investment: Understanding gold's enduring economic influence

Gold serves multiple roles in the global economy:

- Store of value during economic uncertainty

- Hedge against inflation and currency devaluation

- Central bank reserve asset

- Industrial and technological component

💡 Gold remains one of the most stable stores of value throughout economic history.

Historical Perspective: Gold as Economic Stability

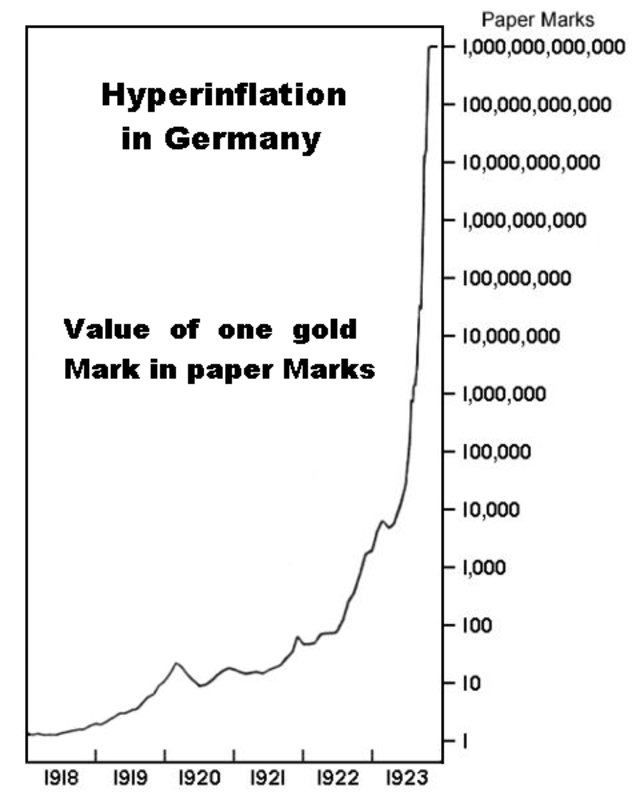

Throughout history, gold has served as a beacon of stability during economic turmoil. One of the most dramatic examples comes from the Weimar Republic's hyperinflation period in Germany (1918-1923).

Chart showing the dramatic rise in paper marks needed to equal one gold mark during German hyperinflation (1918-1923), demonstrating gold's stability during currency crisis.

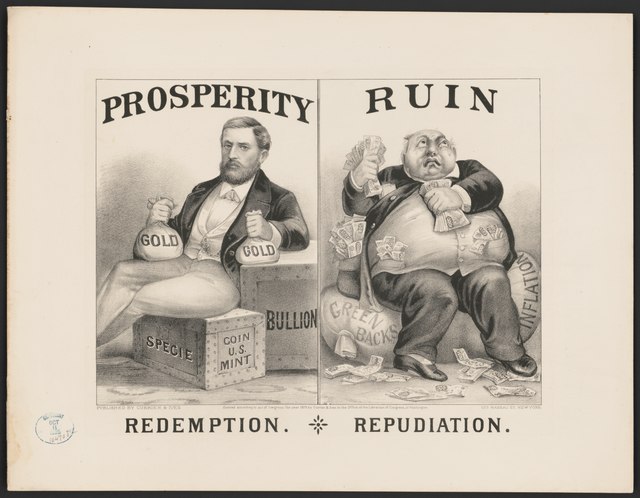

19th-century political cartoon contrasting the prosperity of gold-backed currency (left) with the potential ruin of unbacked paper money (right).

Lessons from History:

- Gold maintains value during hyperinflation

- Provides economic stability during crises

- Serves as a universal currency

- Acts as a hedge against government policy

Looking to Sell Your Gold?

Get a professional valuation based on current market rates and gold content.

Get Your Free QuoteModern Economic Factors Affecting Gold

Today's gold market is influenced by a complex web of factors, from traditional economic indicators to modern financial instruments.

Key factors influencing modern gold prices: inflation, supply factors, central bank policies, ETFs, and long-term value retention.

The New York Stock Exchange trading floor, where gold futures and ETFs are actively traded alongside other financial instruments.

Key Market Influences:

- Global economic uncertainty

- Currency exchange rates

- Central bank policies

- Geopolitical events

- Supply and demand dynamics

Future Economic Implications

The future role of gold in the global economy continues to evolve with changing technology and market dynamics.

Modern gold mining operations represent significant economic activity and employment in resource-rich nations.

Emerging Trends:

- Digital gold and blockchain technology

- Environmental, Social, and Governance (ESG) considerations

- Changing central bank policies

- New industrial applications

Want to understand your gold's current market value? Get expert insights and valuation.

Get Your Free AnalysisGold in Modern Investment Portfolios

Contemporary investment strategies often include gold for:

- Portfolio diversification

- Risk management

- Inflation protection

- Currency hedging

Economic Outlook and Recommendations

As global economic uncertainties persist, gold continues to play vital roles:

- Safe-haven asset during market volatility

- Store of value in developing economies

- Strategic reserve for central banks

- Industrial component in technology

Do you have gold to sell?

Get a professional valuation and instant payment based on current market rates.

Get Your Free Quote